The Forex market, known as the largest financial market in the world, sees an average daily trading volume exceeding $6 trillion. While this presents immense opportunities to traders worldwide, it also comes with significant risks, primarily tied to your choice of a Forex broker. Choosing the right broker is crucial for a secure, efficient, and rewarding trading experience. This guide will walk you through the essential factors to consider when selecting a forex broker and help you make an informed decision.

Why Choosing the Right Forex Broker Matters

Your broker plays a central role in your trading success. A trustworthy broker ensures secure transactions, transparent dealings, and efficient access to the Forex market. On the other hand, selecting an unregulated or unreliable broker could lead to scams, delayed withdrawals, or even account fraud. The stakes are high, so making an informed decision is essential.

Let’s explore the key factors to consider when choosing the right Forex broker.

1. Regulation and Safety of Funds

The foremost consideration when selecting a Forex broker is regulation. A regulated broker is licensed and monitored by a reputable financial authority, ensuring compliance with strict standards for transparency and fairness. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, and the Australian Securities and Investments Commission (ASIC) are among the most respected.

How to Verify Regulation:

- Check the broker’s website for details about its regulatory status.

- Cross-check the broker’s license number on the relevant financial authority’s website.

- Look for segregated client accounts, which ensure your funds are kept separate from the broker’s operational funds.

Foreign exchange scams are still prevalent; in 2022 alone, Forex-related fraud resulted in losses exceeding $1 billion globally. Regulatory oversight protects traders against such risks, making this step non-negotiable.

2. Trading Platform and Technology

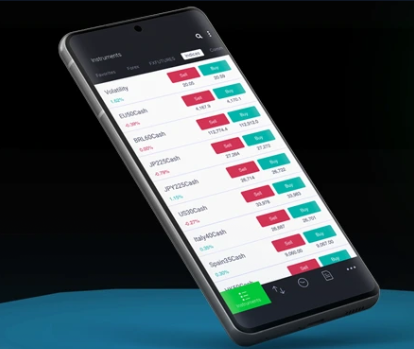

The trading platform serves as your primary interface for executing trades, analyzing market trends, and managing your portfolio. A reliable and intuitive trading platform can significantly enhance your trading efficiency.

Key Features to Look For:

- User-Friendly Interface: Ensure that the platform is easy to use, especially if you are a beginner.

- Advanced Tools: Look for features such as charts, technical analysis tools, and automated trading capabilities.

- Mobile Trading: A responsive mobile app allows you to manage trades on the go.

- Reliability: Platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader are popular for their robust features and stability.

Additionally, ensure the platform operates with minimal downtime and offers fast order execution, especially during volatile market conditions.

3. Types of Accounts and Trading Costs

Understanding the cost structure and variety of accounts offered by a broker is crucial for profitability.

Account Types:

Most brokers offer several account types tailored to traders’ needs:

- Standard Accounts: Suitable for most traders, typically with average spreads and no commission.

- ECN Accounts: Provide direct access to the interbank market with tighter spreads, ideal for experienced traders.

- Demo Accounts: Allow you to practice trading with virtual funds before committing real money.

Costs to Consider:

- Spreads: This is the difference between the buy and sell price. Lower spreads are generally better for active traders.

- Commissions: Some brokers charge a fixed fee per trade instead of a spread.

- Swaps: Overnight fees applied for holding positions overnight in certain account types.

- Hidden Fees: Look for transparency in costs, as hidden fees can eat into your profits.

It’s recommended to calculate your trading costs based on your average trade volume and frequency to avoid surprises.

4. Range of Tradable Instruments

Although Forex pairs are the primary focus, for diversification, consider brokers that offer a wide range of trading instruments such as:

- Major Pairs (e.g., EUR/USD, GBP/USD)

- Minor Pairs (e.g., EUR/CHF, GBP/CAD)

- Exotics (e.g., USD/TRY, USD/ZAR)

- Other Assets: Commodities, indices, stocks, and cryptocurrencies

This diversity allows you to spread risk and take advantage of opportunities across different markets.

5. Customer Support and Resources

Problems can arise at any time, and responsive customer support is critical for a seamless trading experience.

What to Look for in Customer Support:

- Availability: 24/7 support is preferable, especially for Forex, as trading occurs around the clock.

- Channels of Communication: Look for brokers that offer live chat, email, and phone support.

- Knowledgeable Representatives: The support team should provide accurate and helpful answers to your questions.

Additionally, consider brokers that offer educational resources such as webinars, tutorials, and market analyses, enabling you to enhance your trading skills.

6. Leverage and Risk Management

Leverage is a powerful tool in Forex trading that allows you to control larger positions with a smaller amount of capital. However, it also magnifies risks.

Leverage Options:

Different brokers offer varying leverage ratios, sometimes as high as 1:500 or more. While high leverage may seem appealing, it’s not always advisable, particularly for inexperienced traders.

Risk Management Features:

- Negative Balance Protection ensures you don’t lose more than your initial deposit.

- Risk Management Tools such as stop-loss and take-profit orders help protect your account from extreme market volatility.

Always choose a leverage level suited to your risk tolerance and trading strategy.

7. Reputation and Reviews

A broker’s reputation within the trading community says a lot about its reliability and service quality. Take time to research online reviews, trader forums, and independent ratings.

Things to Look For:

- Positive experiences with withdrawals and order execution

- Transparency in fees and policies

- Avoid brokers with a history of misconduct or a large number of unresolved complaints

Word of mouth and community sentiment provide valuable insights beyond what the broker advertises.

8. Test with a Demo Account

If you’re still unsure about a broker, test them out using a demo account. This allows you to evaluate the broker’s trading platform, execution speed, and customer service without risking real money. Many brokers offer demo accounts that simulate live trading conditions, giving you a risk-free way to assess their platform’s performance.

The Bottom Line

Your choice of Forex broker can make or break your trading experience. By prioritizing regulation, trading platform quality, cost transparency, and customer support, you set yourself up for success in the Forex market.

Take your time to research, verify, and test brokers before committing your funds, and remember to align your choice with your trading goals and risk tolerance. The ideal broker will not only ensure your trading security but also guide you toward a more efficient and profitable trading journey.