Forex trading has surged in popularity, offering the potential for significant financial gains in one of the world’s most liquid markets. However, success in the forex market doesn’t just depend on strategy or trading expertise; it also hinges on an equally important decision—choosing the right forex broker. With countless options available, selecting a broker can be overwhelming, but it is a critical step that directly impacts your trading outcomes. This article will explore the essential factors to consider when selecting a forex broker, ensuring that you make an informed choice that sets you on the path to trading success.

Why Choosing the Right Forex Broker Matters

Before we get into the practical steps for choosing a broker, it’s crucial to understand why this decision is so significant. A forex broker acts as the intermediary between you and the forex market, providing the platform, tools, and support you need to trade currency pairs. The right broker not only ensures that your trades are executed efficiently but also prioritizes transparency, security, and usability.

Unfortunately, the forex industry also attracts entities that may not operate with the highest standards of integrity. Without due diligence, traders risk falling victim to unregulated brokers, poor trading platforms, or exorbitant costs that eat into profits. This is why choosing a trustworthy broker is paramount.

Key Factors to Consider When Selecting a Forex Broker

1. and Licensing

The first and foremost factor to examine when assessing a forex broker is whether they are regulated by a recognized authority. A regulated broker is required to adhere to specific financial standards and practices, which protect traders against fraud and unethical practices. Reputable regulatory bodies include:

- United States: Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA)

- United Kingdom: Financial Conduct Authority

- Australia: Australian Securities and Investments Commission (ASIC)

- European Union Countries: Cyprus Securities and Exchange Commission Checking a broker’s regulatory status is non-negotiable. This step ensures your funds are kept in segregated accounts and that the broker operates under strict oversight.

2. Trading Costs and Fees

Every forex trade incurs costs, typically in the form of spreads, commissions, or overnight rollover fees. Understanding a broker’s fee structure is essential to evaluate the true cost of trading with them. Here’s what you should look for:

- Spreads: The difference between the bid and ask price of a currency pair. Narrow spreads are preferable, especially for frequent traders.

- Commissions: Some brokers charge a fixed or percentage-based commission per trade. Ensure this is clearly disclosed.

- Swap/Rollover Fees: Fees for holding positions overnight.

It’s also worth considering whether the broker offers fixed or variable spreads. While fixed spreads remain constant during all market conditions, variable spreads may widen significantly during periods of high volatility.

3. Trading Platform and Technology

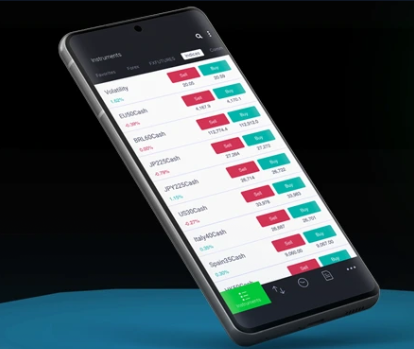

Your trading platform is where all the magic happens. A reliable, intuitive, and user-friendly platform can make a world of difference in your trading experience. Key features to look for include:

- Ease of Use: A clean and navigable interface that minimizes errors while executing trades.

- Charting and Analysis Tools: Platforms should offer robust charting capabilities, indicators, and tools to support your technical analysis.

- Execution Speed: A platform that ensures fast execution minimizes slippage and enhances trading precision.

- Mobile Access: The ability to trade on-the-go via mobile apps ensures flexibility.

Popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are industry standards, but some brokers also offer proprietary platforms. Evaluate the platform in demo mode before committing.

4. Available Currency Pairs

While most brokers cover major forex pairs like EUR/USD, GBP/USD, and USD/JPY, not all offer a wide variety of minor or exotic pairs. Consider your trading strategy and goals when evaluating a broker’s currency pair offerings. For instance, if you’re interested in diversifying beyond major pairs, look for brokers with extensive offerings in minor pairs (e.g., AUD/NZD) or exotics (e.g. USD/TRY).

5. Account Types and Minimum Deposits

Forex brokers often cater to different types of traders with varying account options. Consider your trading style, experience level, risk tolerance, and budget when selecting a broker with the right account type. Typical account options include:

- Standard Accounts: Best suited for beginner traders or those trading with moderate capital.

- Mini or Micro Accounts: Allow lower minimum deposits and smaller trade sizes for those wishing to trade with reduced risk.

- VIP or Premium Accounts: Offer reduced costs, better customer service, and perks for high-volume traders.

Ensure that the broker’s minimum deposit requirement aligns with your financial capacity, and seek out brokers providing leverage that suits your risk tolerance.

6. Leverage and Margin

Leverage enables traders to control larger positions with smaller amounts of capital. While it multiplies potential profits, it also increases risk. Leading brokers typically offer leverage ratios between 30:1 and 500:1, depending on the regulatory restrictions of their region.

It’s essential to strike the right balance here. Excessively can expose traders to enormous risk, while too little leverage can constrain profitability.

7. Customer Support

A forex broker is more than just a platform provider. They should also offer comprehensive customer support. Technical issues, withdrawals, and account inquiries can arise, and having access to prompt and knowledgeable assistance is invaluable.

Look for brokers that offer:

- 24/7 support.

- Multiple contact channels, including phone, email, and live chat.

- Support in your preferred language.

Test their responsiveness by reaching out with queries before opening an account.

8. Reputation and User Reviews

Finally, explore online reviews, forex forums, and trader testimonials to get a sense of the broker’s reputation within the trading community. While no broker will have a perfect track record, consistent negative feedback should raise concerns. Pay special attention to issues like withdrawal problems, unexplained fees, or poor customer service standards.

Red Flags to Watch Out For

Even with proper due diligence, it’s essential to remain vigilant for warning signs that a broker might not be legitimate. Red flags include:

- Lack of transparency regarding fees or regulatory status.

- Guaranteed profits or unrealistic claims.

- Unsolicited marketing or pressure to deposit funds.

- Limited communication or hard-to-reach customer support.

Practical Tips for Success in Selecting a Forex Broker

- Use Demo Accounts: Almost all reputable brokers offer free demo accounts. Leverage these accounts to practice trading, test the broker’s platform, and assess key features.

- Compare Brokers: Don’t settle for the first broker you come across. Compare multiple brokers side by side based on the criteria outlined above.

- Start Small: Begin with a modest deposit to test withdrawals, execution, and platform reliability. Once satisfied, you can increase your investment.

Final Thoughts

Selecting the right forex broker is a fundamental step toward achieving trading success. Beyond simply enabling access to the forex market, a suitable broker acts as a reliable partner, ensuring your trades are executed smoothly while providing valuable tools and support.

By considering factors like , cost, platform quality, and customer service, and by conducting thorough research, you can significantly enhance your chances of success in the forex market. Stay informed, be cautious, and commit to ongoing learning as you continue your trading journey.